The year 2025 marks a turning point in the way individuals manage, visualize and grow their personal finances. The rapid advancements in artificial intelligence, behavioral data modeling and cloud based finance automation have enabled a new generation of applications that do not simply record transactions but actively guide users toward realistic, sustainable financial habits. In a climate where inflation fluctuations, diversified digital investment options and rising living costs challenge everyday decision making, financial clarity has become more valuable than ever.

Among the wave of new releases this year, three standout applications have emerged as the most influential platforms reshaping personal finance for both beginners and advanced users. These apps combine predictive analytics, real time budgeting, proactive recommendation engines and cross platform integration in ways that create far more meaningful financial engagement than traditional tools. This news report explores how these three apps rise above the competition and why they are setting new benchmarks for the global finance technology landscape.

The apps featured in this report include Mintly Vision, BudgetFlow AI and NestPocket Planner, each with unique strengths that have captured the attention of financial advisors, tech analysts and millions of early adopters. Together, they represent the broader digital transformation of personal financial wellness and autonomy in 2025.

Mintly Vision

A New Standard for AI Driven Financial Insight

Mintly Vision is widely recognized as one of the most advanced personal finance apps released this year. Unlike previous generations of expense tracking tools, the core of Mintly Vision is its behavioral prediction engine, which analyzes patterns in user spending, income variability, mood related purchasing tendencies and long term financial goals.

A Deeper Look at Predictive Budget Modeling

Mintly Vision does far more than categorize expenses. Its predictive model evaluates a user’s historical data across months and even years where possible, generating forecasts that anticipate periods of higher spending. This includes seasonal patterns such as holidays or travel seasons but also micro patterns that most users are unaware of.

For instance, the app may notice that a user tends to overspend after receiving a quarterly bonus or that dining expenses increase on weeks when work hours peak. Mintly Vision uses these insights to build proactive counter strategies including smart notifications, alternate spending proposals or automated adjustments to weekly budget allocations.

Reinventing the Financial Dashboard Experience

The user interface of Mintly Vision has also been widely praised for making complex financial summaries easier to understand. Instead of overwhelming charts and spreadsheets, the dashboard uses a dynamic storytelling layout. Each segment of financial activity appears as a narrative card summarizing personal progress, risks, upcoming events and recommended actions.

This makes financial reviews feel more like reading personalized advice from a knowledgeable assistant rather than analyzing cold data.

Investment Micro Adviser

One of the most innovative features is its Micro Adviser system, which tailors investment suggestions according to risk tolerance and available capital. The system does not push users into high stakes choices. Instead, it breaks down investment options into digestible micro decisions such as adjusting monthly contributions or exploring low risk digital funds.

This approach has proven especially helpful for new investors who often hesitate due to lack of confidence or knowledge.

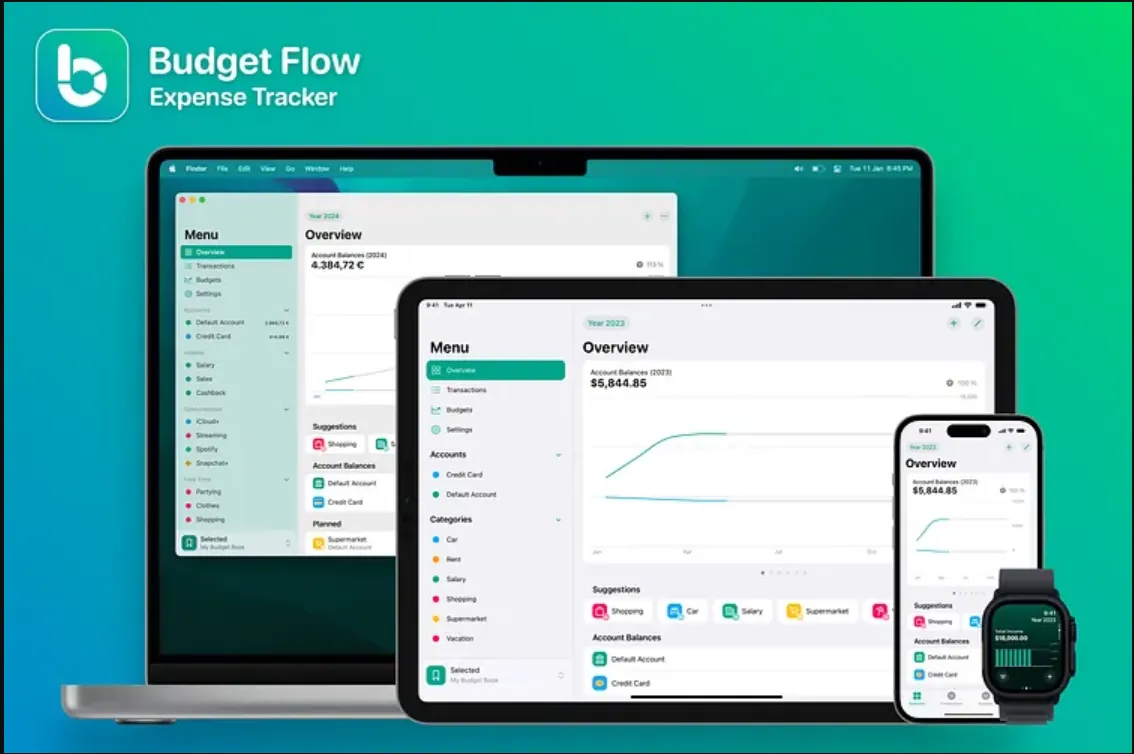

BudgetFlow AI

The Ultimate Automation Engine for Daily Financial Discipline

While Mintly Vision focuses heavily on predictive analysis, BudgetFlow AI excels in automation. Built on a real time financial flow engine, BudgetFlow AI minimizes the manual effort users typically have to invest in tracking expenses and maintaining budgets.

Automated Expense Interpretation

BudgetFlow AI goes beyond transaction categorization by interpreting spending context. The system analyzes transaction timing, vendor type, purchase history and spending clusters to determine what the purchase represents in real life rather than just labeling it.

For example, if a payment is made at a supermarket late at night along with multiple small household purchases earlier in the week, BudgetFlow AI might classify it as a replenishment shopping trip rather than a generic grocery purchase. This granular context helps users understand their spending behavior on a deeper level.

Habit Reinforcement and Accountability

BudgetFlow AI uses a habit reinforcement method inspired by behavioral economics. Instead of sending simple warnings when a user overspends, the app issues micro nudges tailored to personal tendencies.

Some users respond better to motivational messages, while others respond to analytical reminders. BudgetFlow AI identifies which style works and adjusts automatically, creating a highly personalized feedback cycle.

Users can also enable Accountability Mode, a feature that creates weekly check in summaries and goal performance grades. These reports are structured in a way that encourages improvement without inducing guilt or pressure, making them effective for long term budgeting consistency.

Instant Reallocation System

One of the strongest innovations in BudgetFlow AI is its ability to automatically reallocate funds in real time. When the system detects that a user has exceeded or fallen behind a certain budget category, it suggests or performs budget adjustments to maintain balance.

For example, if dining expenses unexpectedly rise in one week, the app may reduce entertainment or discretionary budgets the following week to compensate. The result is a smoother financial journey with fewer abrupt imbalances.

NestPocket Planner

Personal Wealth Planning Reinvented for the Modern Generation

NestPocket Planner sets itself apart by focusing on long term financial planning rather than short term budgeting. The app is built around the idea that many individuals struggle not because they do not manage money daily but because they lack a comprehensive roadmap for future milestones.

Life Goal Structuring with Visual Roadmaps

NestPocket Planner’s flagship feature is its Life Roadmap Builder. This interactive tool allows users to map out long term goals such as buying a home, retiring early, starting a business or pursuing higher education.

The builder creates detailed step by step financial pathways for each goal including savings milestones, risk scenarios, cost projections and timeline adjustments. Users can customize their plans by adjusting income assumptions, expected inflation and future lifestyle changes.

The visual roadmap makes abstract goals feel achievable, which is why the app has become popular among young professionals seeking strategic life planning.

Smart Family Finance Mode

Another standout feature is its Family Finance Mode, which integrates multi user financial data in a transparent yet secure manner. This mode is ideal for couples or households looking to build collective wealth.

Users can set joint goals, assign responsibilities, assess shared expenses and monitor combined financial progress. The system offers conflict reduction tools by highlighting areas where spending styles differ and offering balanced compromises.

Adaptive Emergency Planning

NestPocket Planner also excels in preparing users for unexpected life events. The Emergency Projection Engine analyzes a user's financial vulnerability by simulating scenarios such as job loss, medical costs or sudden relocations. The app then calculates the ideal emergency fund size, recommended investment liquidity and short term budget adjustments.

This feature has gained significant popularity in 2025 due to rapidly shifting global economic conditions, making NestPocket Planner not only a financial assistant but also a resilience builder.

The Rising Trend Behind These Next Generation Finance Apps

Why 2025 Is the Breakthrough Year for Digital Personal Financial Tools

The rise of Mintly Vision, BudgetFlow AI and NestPocket Planner reflects broader global trends. As remote working became more normalized, side income streams diversified and inflation uncertainty increased, consumers began demanding more reliable and intelligent financial tools. Traditional spreadsheets and basic budgeting apps were no longer enough.

Additionally, the widespread acceptance of AI driven assistants has made users more comfortable with automated recommendations. Privacy improvements and stronger encryption standards in 2025 also contributed to greater trust in personal finance apps.

The Push Toward Proactive Rather Than Reactive Money Management

Past financial apps were primarily reactive. They showed users what had already happened and left them to interpret the data. The new generation of apps reverses this approach by predicting future outcomes and guiding users to avoid pitfalls before they occur.

This shift represents a fundamental redefinition of personal finance. Instead of simply tracking money, apps have become proactive partners in shaping better financial habits and building long term wealth strategies.

Cross Platform Integration as the New Expectation

All three apps released in 2025 support seamless integration across banking systems, digital wallets, investment platforms and workplace payment accounts. This interconnected infrastructure allows users to view their financial universe as a unified ecosystem.

The removal of fragmented financial information not only simplifies tracking but also enables more accurate forecasting, automated adjustments and multi channel planning.

Conclusion

The three apps highlighted in this report—Mintly Vision, BudgetFlow AI and NestPocket Planner—stand at the forefront of the 2025 financial technology revolution. Each app introduces groundbreaking innovations that go far beyond simple expense tracking. They bring together predictive analytics, personalized automation and long term wealth planning to deliver a new era of financial clarity and empowerment.

Mintly Vision redefines the meaning of financial insight through its deep behavioral predictive systems. BudgetFlow AI sets new standards for automated decision making and disciplined budgeting. NestPocket Planner elevates life planning by transforming future goals into actionable financial strategies.

Together, they represent the future of personal finance technology and embody the global shift from reactive management to proactive financial wellness. As financial tools continue to evolve, these apps serve as the blueprint for what modern financial empowerment should look like in an increasingly complex economic world.